Money Moolah Bucks! is scheduled as a classroom style program In-Person by KYD trainers, or Teacher-Led through an online turnkey module, but can be delivered remotely online. Engaging classroom activities introduce students to responsible financial decision making and reinforce important math skills with real-life application, like goal setting, tracking expenses and creating a budget.

Money Moolah Bucks! is part of KYD's Piggynomics series as it focuses basic economic principles and personal finance... the value of Managing your Moolah!

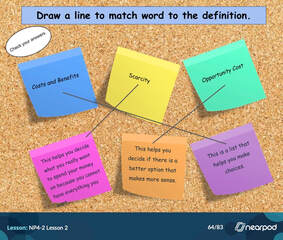

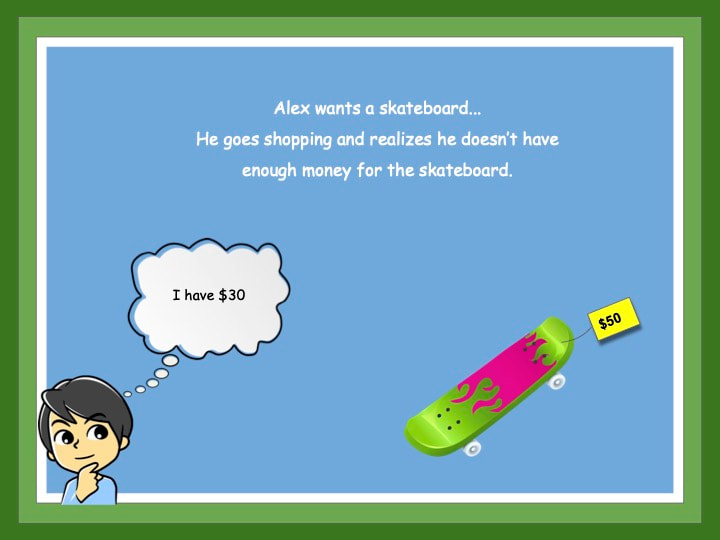

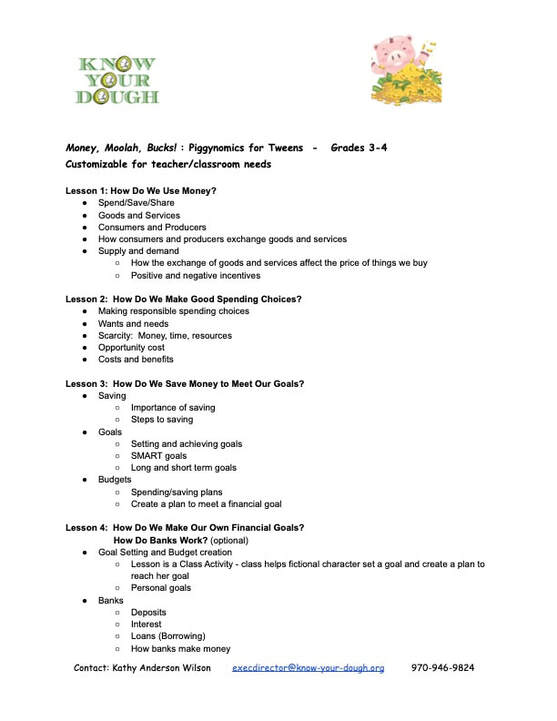

KYD's upper elementary program was completely redesigned in 2021 for online accessibility, this comprehensive program covers creating a plan to meet financial goals, goal setting, saving, budgets, scarcity, opportunity cost, goods/services, consumers/producers, supply/demand, and positive/negative incentives in financial decision making.

The program can be presented through In-Person or Teacher-Led modules using Nearpod or Google Slides, with optional voice-over audio for the teacher-led and remote versions. The modules include interactive online activities, videos, and gamified quizzes where the students compete like a video game!

This program is interactive and FUN!

This program is interactive and FUN!

This comprehensive program covers Colorado Social Studies/Economics Standard 3.5 and Social Studies/Economics/PFL Standard 3.6 (PFL) for Grades 3 and 4.

Students are joined in one learning adventure by Anna Banks, the oldest of the Bankes Piglets: 3 dynamic and diverse “savers” and “spenders.” Some of the piglets make responsible financial choices already . . . and some have a bit to learn.

The Goal Setting and Budget Creation portion of the program focuses on Anna, and the class helps her reach her goals by recognizing her good and bad financial habits, and helps her make responsible choices. By analyzing the habits of the piglets and helping them make better financial decisions, students learn the importance of

“feeding the pig!”.

Students build lasting knowledge of financial literacy concepts.

(Colorado State Standard/Economics/PFL 3rd grade 3.6)

The Goal Setting and Budget Creation portion of the program focuses on Anna, and the class helps her reach her goals by recognizing her good and bad financial habits, and helps her make responsible choices. By analyzing the habits of the piglets and helping them make better financial decisions, students learn the importance of

“feeding the pig!”.

Students build lasting knowledge of financial literacy concepts.

(Colorado State Standard/Economics/PFL 3rd grade 3.6)

KYD offers 3 ways to present our Financial Literacy Programs:

Online remote and teacher-led programs are presented in slide form with optional voice-over audio. This program is interactive and FUN!

- In-person, in-classroom delivery by trained volunteer educators

- Turn-key teacher-led audio-included program modules

- Remote online interactive programs

Online remote and teacher-led programs are presented in slide form with optional voice-over audio. This program is interactive and FUN!

All programs and lessons are customizable for your individual classroom needs.