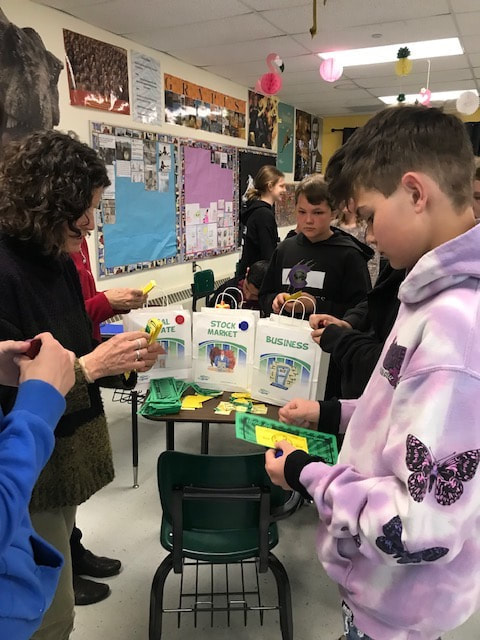

Middle Schoolers (and older) learn through playing an experiential 5-day financial education game (The Money Game®) where the room is the “board”, and the students are the “tokens”!

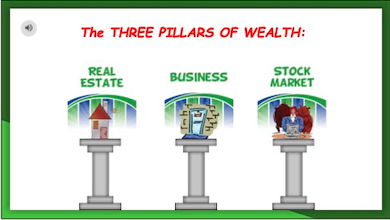

Students learn important concepts such as payroll taxes, insurance, credit/credit scores, compound interest, earning money, paying expenses, investing, passive income, and saving for the future. They individually "win" the game when their passive income exceeds their chosen lifestyle (expenses) so they are financially free and can "retire". After they "win", they continue to build their wealth until the game ends for the class.

Our goal is to create a generation of adults who are

responsible, resourceful and self-reliant.

responsible, resourceful and self-reliant.

The Money Game®is not a board game, it is experiential...

the room is the board and YOU are the game token!

the room is the board and YOU are the game token!

Perfomance Results

KYD administers identiical pre-program and post-program tests. The tests are divided into two sections: Financial Behaviors and Financial Skills. We measure results as improvement in students test scores from pre- to post program.

|

2022-23 School Year

Performance Measurement: Middle School |

|

*The Overall performance is the average of overall test score improvement (.

**The Behavioral portion of the test measures positive changes in the students' financial behaviors after completing the program.

***The Skills portion of the test measures the financial knowledge and skills gained during the program!

**The Behavioral portion of the test measures positive changes in the students' financial behaviors after completing the program.

***The Skills portion of the test measures the financial knowledge and skills gained during the program!

KYD offers 2 ways to present our Financial Literacy Programs:

- In-person, in-classroom delivery by trained volunteer educators (1 week unit)

- Turn-key teacher-led audio-included program modules